None of those stores exist today in their original form...yet at their height, Bonwit Teller, Lord & Taylor, Henri Bendel were the toast of the Big Apple and admired by retailers from coast to coast.

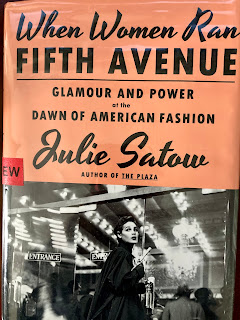

For an inside look at New York department stores during their heyday, I recommend this well-researched, well-written nonfiction book.